More Nations Unite to Sanction Prince Group, a Huge Crypto Scam Organization Making Billions

Imagine scrolling through your social media feed, only to click on what seems like a golden opportunity—a friendly chat that blooms into a crypto investment tip promising quick riches. Before you know it, you’ve wired thousands to an offshore account, and poof, it’s gone. That’s the grim reality for countless Americans ensnared by “pig butchering” scams, those insidious operations where fraudsters groom victims online before bleeding them dry. Now, South Korea’s bold entry into the fray against these networks is a shot in the arm for U.S. efforts to reclaim our economic security from foreign predators.

On Thursday, Seoul dropped its first-ever independent sanctions aimed at transnational crime, targeting a whopping 15 individuals and 132 entities. This isn’t just paperwork—it’s the “largest single sanction measure in history,” as South Korea’s Ministry of Foreign Affairs put it in an official release. “It shows the government’s firm determination to actively respond to online organized crime in Southeast Asia that is causing serious damage at home and abroad.”

For everyday Americans, whose retirement savings and hard-earned cash fuel these scams to the tune of billions lost annually, this means fewer safe havens for the crooks.

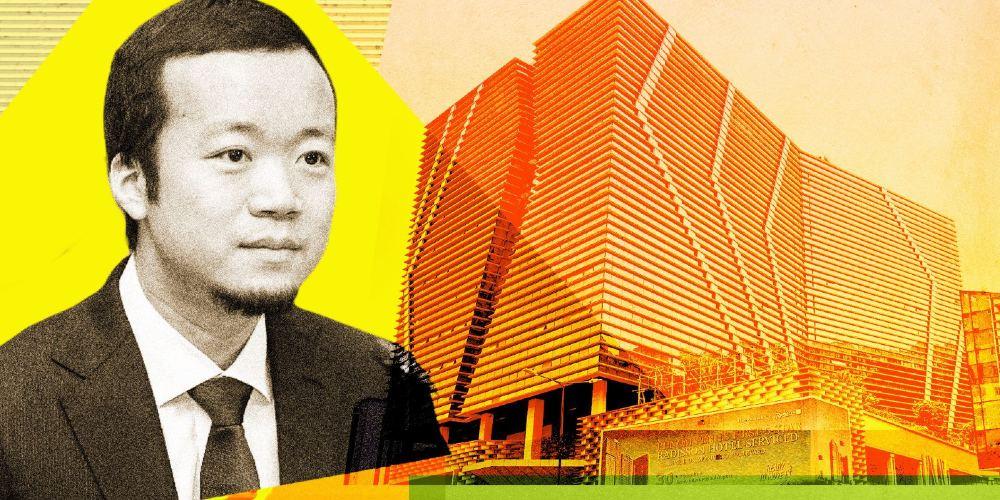

At the heart of the crackdown sits the Prince Group, a Cambodia-based conglomerate led by Chen Zhi, a 38-year-old Chinese national also known as “Vincent.” U.S. authorities have painted a stark picture: Prince allegedly ran sprawling “scam centers” in Cambodia and Myanmar, stuffing them with trafficked workers—lured by bogus job ads—forced to man 1,250 mobile phones controlling 76,000 fake social media accounts.

These setups didn’t just target South Koreans; they preyed on folks worldwide, including a surge of American victims in recent years. The U.S. Treasury slapped Prince with a “Transnational Criminal Organization” label back in October, right alongside the UK, which detailed how these outfits peddle love scams and crypto cons under the shadow of torture threats.

Zhi himself faces federal charges in New York for wire fraud and money laundering conspiracies, with the Department of Justice seizing about $15 billion in bitcoin from his wallets on October 14. That’s real money—enough to fund entire communities back home—stolen from trusting Americans chasing the dream of financial independence.

And it’s not isolated: The same sanctions netted Huione Group, another Cambodian player the Treasury fingered in May as a key laundry for North Korean cyber heists and Southeast Asian fraud rings.

“Huione Group serves as a critical node for laundering proceeds of cyber heists carried out by the Democratic People’s Republic of Korea (DPRK), and for Transnational Criminal Organizations in Southeast Asia perpetrating virtual currency investment scams,” the department warned.

Prince, for its part, fired back through high-powered U.S. lawyers at Boies Schiller Flexner. “The recent allegations are baseless and appear aimed at justifying the unlawful seizure of assets worth billions of dollars,” the group claimed in a November 11 statement.

They’re lawyered up and denying it all—but the mounting evidence from Phnom Penh to Washington tells a different story. Singapore piled on last month, freezing over 150 million Singapore dollars in assets tied to the network, from bank accounts to cold hard cash.

This international pile-on didn’t happen in a vacuum. It kicked into high gear after a gut-wrenching incident in August: a South Korean university student tortured to death in a Cambodian scam compound. That tragedy spurred Seoul and Phnom Penh to launch a joint task force in October, a practical step toward dismantling these human-trafficking-fueled fraud factories. For the U.S., it’s a reminder of why we lead on sanctions—our Treasury’s moves often light the fuse for allies to follow, starving these operations of the global financial lifelines they need to thrive.

What does this mean for American families and businesses? Less tolerance for the kind of economic sabotage that erodes trust in our markets and drains wealth from Main Street. These scams aren’t victimless—they hit retirees in Florida, young investors in Texas, and small savers everywhere, turning the promise of American opportunity into a nightmare. By joining forces with Seoul, London, and beyond, we’re not just punishing the guilty; we’re fortifying our borders against digital thieves. It’s a win for free enterprise, where honest work and smart risks should pay off, not line the pockets of overseas kingpins.

As probes deepen, keep an eye on your inboxes and feeds—verify before you invest, and report the suspicious. In the end, cracking down on these empires isn’t charity; it’s essential to keeping America’s economic engine humming strong.