OOPS: Crypto Company Accidentally Sent $40B in Bitcoin to Users PLEASE SEND ME SOME TOO!

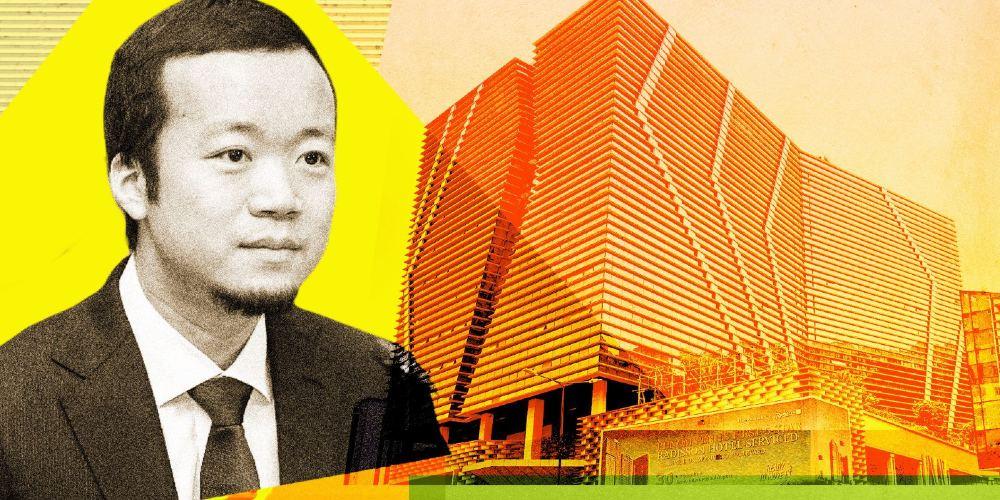

South Korean exchange Bithumb just delivered a masterclass in operational disaster. On Friday, what started as a routine promotional giveaway spiraled into one of the industry’s most embarrassing mishaps: the accidental crediting of over 620,000 Bitcoins—valued at more than $40 billion—to hundreds of users. This wasn’t a generous windfall but a ledger error that triggered a flash crash on the platform, exposing the fragility of centralized exchanges and igniting debates about their true reserves.

The incident unfolded during a promotional event intended to reward users with small cash prizes of around 2,000 Korean won, roughly $1.50. Instead, due to what Bithumb described as a staff input error—mistakenly entering “BTC” instead of “KRW”—select users saw their accounts balloon with phantom balances of up to 2,000 Bitcoins each.

Reports vary on the exact number of affected users, with some sources citing 695 and others 249, but the total credited amount consistently lands at 620,000 BTC, representing nearly 3% of Bitcoin’s entire supply. These weren’t actual transfers of real coins; they were “ghost balances” created in the exchange’s internal system, allowing users to attempt trades as if the funds were legitimate.

Chaos ensued almost immediately. Recipients, spotting the massive windfalls, rushed to sell, flooding the order books and driving Bitcoin’s price on Bithumb down by as much as 17% to about 81 million won, equivalent to $55,000—well below the global market rate of around $68,000 to $70,000. The exchange acted swiftly, halting trading and withdrawals for the affected accounts within 35 minutes, and claimed to have stabilized the situation in just five minutes after the price volatility began. Bithumb emphasized that no external hack or security breach was involved, pinning the blame squarely on internal human error.

Today, Bithumb issued a public apology: “We sincerely apologise for the inconvenience caused to our customers due to the confusion that occurred during the distribution process of this (promotional) event.”

The company reported recovering 99.7% of the erroneously credited Bitcoins, pledging to cover the remaining 0.3%—likely from small sales that slipped through before the freeze—using its own assets. This quick response mitigated immediate financial losses, but the damage to user trust and market stability was already done.

Social media erupted with a mix of amusement and alarm. One X user quipped about the “dream drop” turned nightmare, noting how a staff member’s typo turned $1.50 prizes into $133 million illusions. Others highlighted the operational risks, with posts warning that such errors underscore the perils of relying on centralized platforms. The incident even prompted discussions about market liquidity and the potential for similar glitches to cause broader disruptions.

Digging deeper, this blunder raises uncomfortable questions about Bithumb’s reserves. As of the third quarter of 2024, the exchange held only 42,619 BTC—far less than the 620,000 it “allocated” in error. How could a system allow for such massive over-crediting without safeguards? Critics in the crypto community are now debating whether this exposes fractional reserve practices, where exchanges might not hold full backing for user balances, echoing concerns from past scandals like FTX. South Korean regulators have launched an investigation, which could lead to stricter oversight on exchange operations.

This comes at a precarious time for Bitcoin, which has been reeling from a recent dip that erased much of the gains following President Donald Trump’s election victory in November 2024. Trump’s pro-crypto stance had initially buoyed the market, but ongoing volatility reminds investors of the asset’s inherent risks. Bithumb’s mishap amplifies those dangers, showing how even established players can falter spectacularly.

While Bithumb insists it was a simple mistake, some observers speculate it could reveal systemic flaws. There’s no concrete evidence of foul play, but history teaches us that dismissed “conspiracies” in finance—like hidden leverage or insider manipulations—sometimes prove true. For now, the facts point to incompetence rather than malice, but the episode demands accountability.

Users affected by the freeze and volatility deserve more than apologies; they need assurances that such errors won’t recur. Bithumb’s promise to self-fund losses is a start, but rebuilding confidence will require transparency about internal controls and reserves.

In the end, this $40 billion fiasco serves as a stark reminder: In crypto, where decentralization is the ideal, centralized exchanges remain a weak link. Investors should weigh the convenience against the risks, and regulators must step up to prevent the next blunder from becoming a catastrophe.