Pentagon Prepares for IRAN DETERRENT STRIKE

Unprecedented number of B-2 bombers amassed for Iran strike

In the largest single deployment of stealth bombers in U.S. history, the Pentagon has sent six B-2 “Spirit” aircraft to Diego Garcia in the Indian Ocean.

The long-range bombers, which are uniquely suited to evade Iranian air defenses and can carry America’s most potent bunker busting weapons, flew in from Missouri last week in a little noticed operation.

The B-2s carry not just bombs, but a message for Iran: “do you see our sword?,” as one retired general told Newsmax this week.

President Donald Trump hasn’t been shy in threatening Iran, saying that if Tehran doesn’t close the door on a nuclear capability they will experience “bombing the likes of which they haven’t seen.”

“Hell” will “rain down” on the country, Trump has also said. Just today, amidst the stock market meltdown Trump again reiterated his threat, saying that “doing a deal would be preferable to doing the obvious” — which to the president is undertaking a massive strike.

Blatant as the threat is, the U.S. government has not otherwise publicly acknowledged the bomber buildup. Though B-2 bombers were used to carry out strikes on underground Houthi facilities in Yemen (both under the Biden and Trump administration), the forward deployment of the bombers to the island of Diego Garcia was only reported when commercial satellite images of the airbase there revealed the six on the runway.

“To my knowledge, this is the largest B-2 deployment to a forward location,” Hans Kristensen, director of the Nuclear Information Project at the Federation of American Scientists told me. Kristensen is the world’s leading tracker of nuclear comings and goings.

“All the bombers, they’re not in hangers, they’re underneath satellites where they can be photographed and seen; and the idea is, do you see our sword?” retired Air Force Brig. Gen. Blaine Holt, who served as Deputy U.S. Military Representative to NATO, said in an interview with Newsmax last week. Holt also said that the B-2 deployment “gives the president a military option that he can actually use these weapons against Iran if needed.”

This is a highly visible threat to Tehran, but at least one party isn’t supposed to notice: the American people.

The Pentagon refuses to acknowledge that the deployment is even happening. Trump’s new Pentagon Press Secretary Sean Parnell has only vaguely alluded to “other air assets” being deployed it has announced that two aircraft carriers will stay in the region, the result of a delay in sending one home after its current deployment.

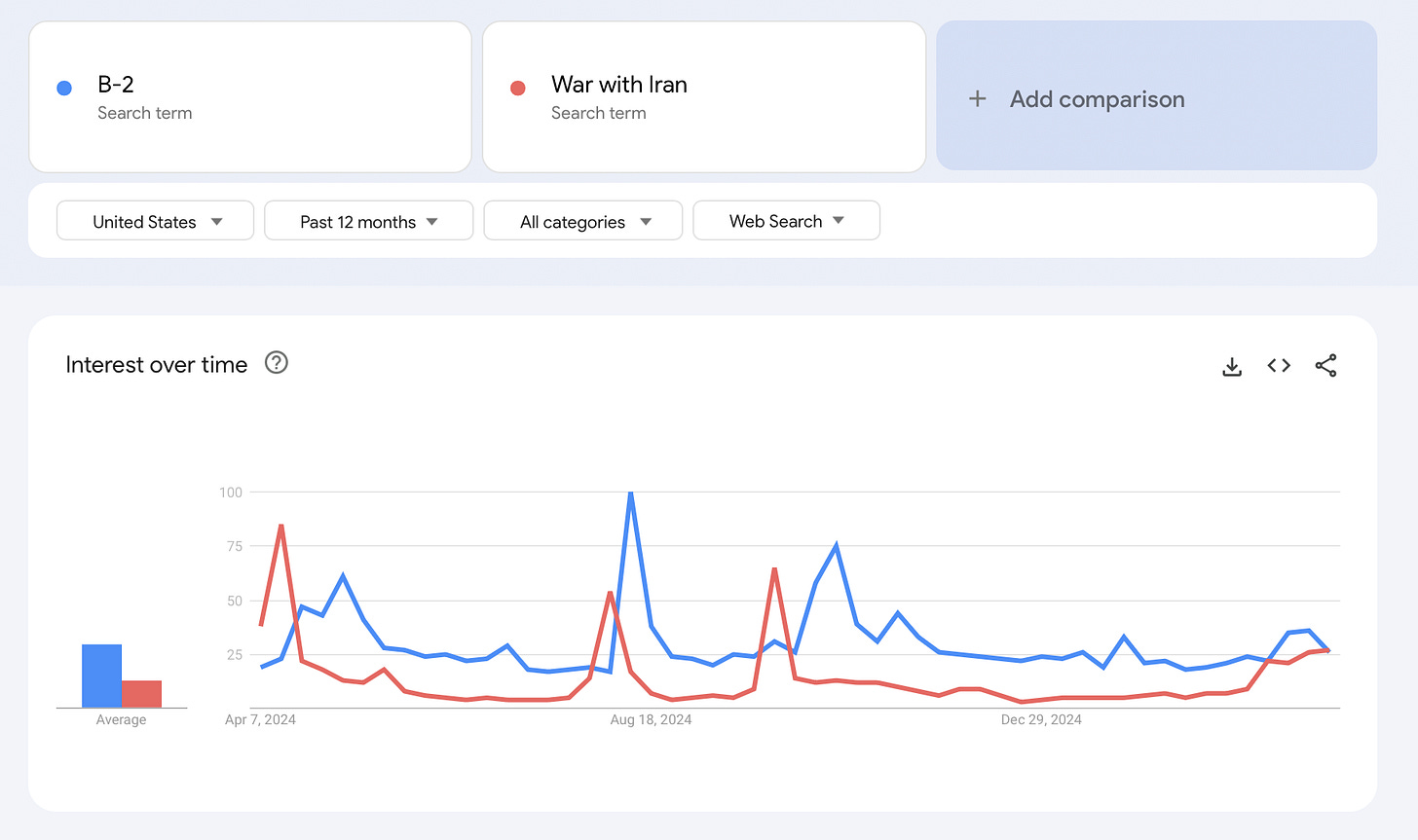

According to Google Trends, searches for terms like “B-2” and “war with Iran” have only modestly increased, indicating that public curiosity has been suppressed despite Donald Trump’s many threats to attack his enemies.

Why B-2s?

The B-2 was first designed during the Cold War to penetrate deep into Russian territory for a nuclear attack. The aircraft’s stealth features (making it all but “invisible” to conventional radar) allow it to evade even the most sophisticated air defenses. Subsequent to its deployment, the bomber was modified so that it could take on unique conventional roles as well, especially in attacking underground facilities.

Though the U.S. has a variety of long-range fighters in the region — F-16s, F/A-18s, F-15Es, and F-35s — deployed on aircraft carriers and based in countries like Jordan and the UAE, the B-2s also allow the Trump administration to carry out unilateral strikes. That is, without the permission or involvement of any other Middle East countries. (Diego Garcia continues to be militarily controlled by the U.K.)

Affording a unilateral option, the bombers also fulfill one of the priorities of the Pentagon and the administration in undertaking any use of force: making sure that the risk to U.S. personnel is minimal. Though they are much more expensive to operate and even deploy, the risk of one of the B-2s getting shot down is lower than that of fighters.

As I’ve already written, the Pentagon has been developing a new Iran war plan in recent months. That even includes options for the use of nuclear weapons against Iran, which I’ve also written about.

Assuming the B-2 bombers are directly connected to a full-fledged war decision would be a mistake. They are tools much better suited to a single demonstration strike. Note that from Diego Garcia, a round trip flight to Tehran exceeds 6,000 miles (more than 10 hours of flying), thus limiting how many of the bombers could be used in a sustained operation.

Assessing the likelihood of war with Iran requires understanding three distinct parts:

- Intelligence assessments;

- Public muscle flexing (of which the B-2 bombers are part); and

- War planning.

Each of these three elements exists in separate stovepipes and each proceeds along their own timelines and separate approaches to the problem. It is when the three are in sync that the moment of maximum danger emerges. We’re not yet there, but let’s take a look at each of the three.

Intelligence

Intelligence assessments fall into two categories, the big picture and the day-to-day. I recently wrote about the intelligence community’s latest long view of Iran; that is, its assessment of Iran’s overall condition and Tehran’s worldview. That intelligence assessment does not scream war, but again, that’s the intelligence community’s view, not that of the White House.

Day-to-day (or crisis) intelligence — an assessment that Iranian forces are on the move, that Iran is readying an attack, that a terrorist strike is imminent — doesn’t necessarily have to jive with the long-term prognosis as seen by the eggheads in Washington. Crisis intelligence is more of an operational matter.

Though mostly operational in nature, crisis intelligence is also the kind of “intelligence” that leaders at the top have to monitor. Think of it as cable news or some viral social media frenzy. It sucks all of the oxygen out of the brain and there is a tendency to lose touch with the big picture. A contributing factor of crisis intelligence in Trump’s mind is also what’s on Fox or Newsmax — which is to say that’s what this president sees.

Flexing

Which brings us to public muscle flexing of the B-2 deployments. I say flexing because what follows isn’t “war,” not full scale war as people think of war. It is more the preamble of the government or the military taking action to “defend” itself, or an occasion by which the Pentagon expresses anger or frustration, or wants to send a signal, even by bombing.

This is the realm where Donald Trump’s stream of consciousness or Secretary of Defense Pete Hegseth’s need to stick one of his tattoos in someone’s face plays an outsize role. What the boss says in this world is crucially important, even if it is ridiculous, because the war machine has to know at what speed to operate and what thing it should produce. And it needs to know right now, tonight, which is why the B-2s are there in the region in such large numbers.

When Trump spews, even his tone influences the military “posture,” as those who are out “in the field” seek to gauge what the White House is planning so that they can anticipate what’s coming. (It is hardly ever organized or clear under any administration.) Thus Trump’s bombast and his body language influences U.S. moves, which influence how the Iranians see the dangers, which can provoke Tehran to flex its own muscles, which then triggers the crisis intelligence alerts, which makes Trump and company speak more loudly which pushes the U.S. military to make moves to get ready, which the Iranians see, which we see and which starts a never-ending cycle.

You get the idea.

War Planning

Behind all of this is war “planning.”

A common misconception is that the Pentagon has contingency plans for everything, a belief that overlooks how time consuming and irregularly they are produced. War planning is the realm of what’s possible, not just what the president says.

Moving B-2s to Diego Garcia or increasing the number of aircraft carriers in the region, or bringing in more squadrons of aircraft — all of these are muscle flexing actions. Sustained military action with national objectives (e.g. defeat the Iranian military, achieve regime change, eliminate Iran’s nuclear capabilities), are a whole other dimension. This is the world of placing and sustaining troops, not just airplanes, and making sure that they have sufficient supplies, everything from ammunition to meals to medical care.

In the world of war planning, when Trump says “I want X,” the order goes down the chain of command through a mind-boggling number of levels, broadening in scope the further the order goes down the chain until someone (and many someones) say ‘We can’t do it.’ That someone could be anyone, but for simplicity’s sake, think of the ultimate someone as “the Pentagon.” The Pentagon says this and the Pentagon says that.

If the Pentagon wants to do X, they can move mountains to get it done. And that takes time, and lots of resources.

If the Pentagon doesn’t really want to do X, because it thinks the risks are too high or because it thinks the order ill-considered, it has an arsenal of passive aggressive ways of gumming up the works to make sure it doesn’t happen except as it wants. ‘What do you actually mean, Mr. President, sir, that you want to end Tehran?’ the Pentagon asks. ‘Nukes?’ ‘Covert action?’ ‘World War III?’ ‘That looks a lot like Ukraine, or worse, sir. Are you sure?’

You can think of this as calmer heads prevailing, but it is also a game that the Pentagon plays, either to shift responsibility for the outcome to the politicians or as to guide the president’s order so that it ends up looking like it’s asking for what the Pentagon wants, what the Pentagon thinks is possible and will allow it — that is, the Pentagon, not America — to declare victory.

Over the past 24 years, the Pentagon has perfected this game of executing the play it wants to run, not what the coach wants. That’s why the U.S. has become very good at bombing targets and conducting aerial assassinations, and in keeping the ball in play.

The military has grown highly proficient at executing a strike (or defending against one). To those sitting at their desks in Washington, the risk factors of sending off the B-2s to rain down hell seem minor: no American (and even relatively few Iranian civilians) are going to die, world markets aren’t going to be roiled by an oil crisis, and the public isn’t going to much notice. Trump can thus push the button and activate those who are pulling the triggers with relative ease. That’s why these days we see so many instances of one-off bomb strikes. Donald Trump doesn’t seem capable of changing any of this.

But he can yell louder and be more offensive and threaten more. When it comes to Iran, he is revving himself up. It’s not war that the B-2s are threatening. It’s worse than that. This is preparation for reckless action that, from the Pentagon’s perspective, carries little risk. That’s dangerous and is also why the public must to involve itself. But it can’t do that when the Pentagon refuses to publicly acknowledge what it’s doing.

That’s why I do these stories.

I’ve written over a dozen articles over the past year about war with Iran, trying to make the point that it is already here; that the endless tit-for-tat strikes we’ve seen is “war.” We might get to the point where all three elements of the war-making process sync together and ground troops get involved, but in the interim, we are just one or two steps below maximum danger.