Arabs are an ethnic-linguistic group, while Muslims are followers of the religion of Islam. The two are not synonymous—many Arabs are not Muslim, and most Muslims are not Arab.

Here’s a breakdown to clarify the distinction:

🗣️ Arabs: An Ethno-Linguistic Identity

- Definition: Arabs are people who identify with the Arabic language and cultural heritage.

- Geography: Primarily from the Middle East and North Africa (MENA), including countries like Egypt, Saudi Arabia, Iraq, Syria, Lebanon, and Morocco.

- Language: Arabic is their native or ancestral language.

- Religion: While many Arabs are Muslim, there are also Arab Christians, Druze, and other religious minorities.

🕌 Muslims: A Religious Identity

- Definition: Muslims are individuals who follow Islam, a monotheistic Abrahamic religion founded in the 7th century CE.

- Global Reach: Islam is practiced worldwide, with large populations in Indonesia, Pakistan, India, Bangladesh, Turkey, Iran, and sub-Saharan Africa—many of which are not Arab.

- Diversity: Muslims come from diverse ethnic, linguistic, and cultural backgrounds. Being Muslim does not imply any specific ethnicity.

🌍 Overlap and Misconceptions

- The confusion often arises because Islam originated in the Arabian Peninsula, and the Qur’an is written in Arabic.

- However, only about 20% of the world’s Muslims are Arab.

- Conversely, not all Arabs are Muslim—for example, Lebanon and Egypt have significant Arab Christian populations.

Understanding this distinction helps avoid stereotypes and better appreciate the rich diversity within both Arab and Muslim communities.

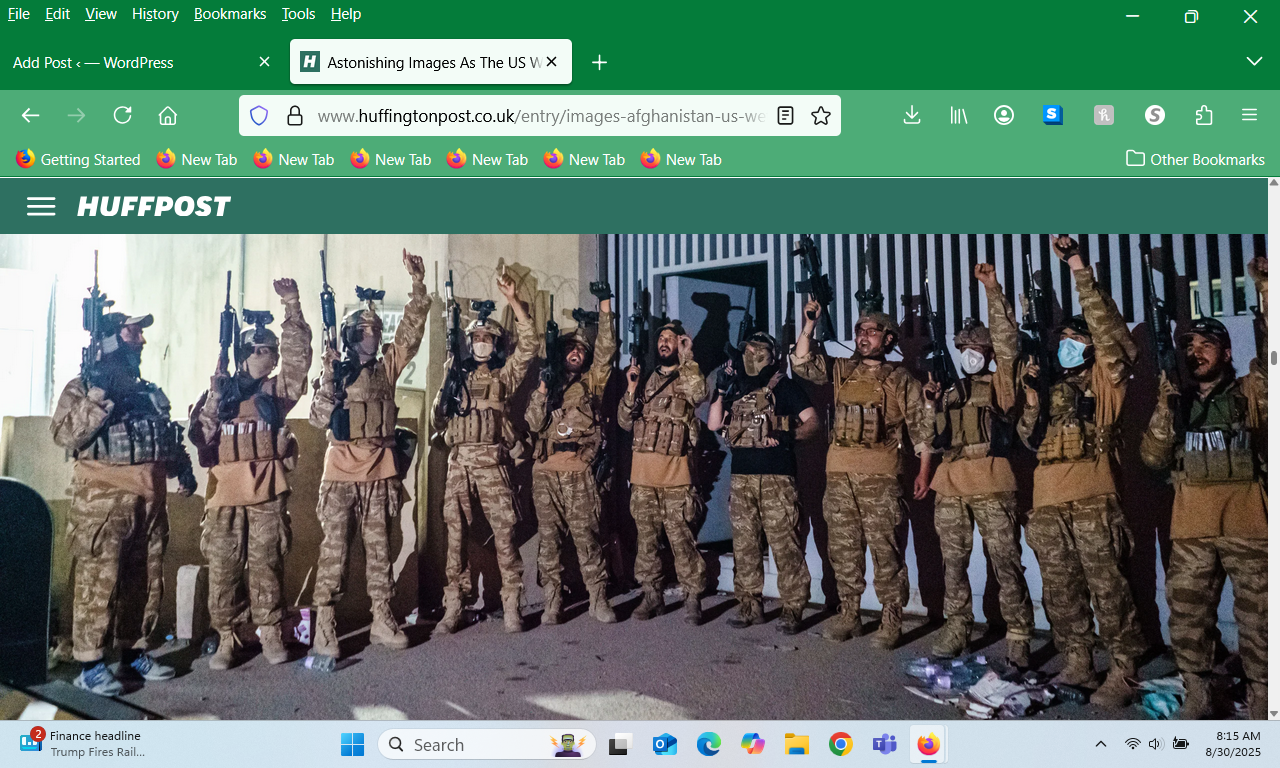

Chairman of the Joint Chiefs of Staff Mark Milley and CENTCOM Commander Frank McKenzie repeatedly ran cover for the Taliban’s behavior in 2021, denying that the Taliban had carried out attacks against U.S. and NATO bases during the withdrawal and defending the Taliban’s behavior during the evacuation.

Chairman of the Joint Chiefs of Staff Mark Milley and CENTCOM Commander Frank McKenzie repeatedly ran cover for the Taliban’s behavior in 2021, denying that the Taliban had carried out attacks against U.S. and NATO bases during the withdrawal and defending the Taliban’s behavior during the evacuation.