| The 95,000-ton Dali was carrying 4,700 cargo containers weighing up to a collective 262,000 tons when it knocked down the Francis Scott Key Bridge early Tuesday, creating what is known in the media business as “a news event” in Baltimore Harbor that dominated the airwaves and headlines for days. |

| But the story is not only in Baltimore Harbor. The story is global. The story spans every sea lane, river, harbor, and port across the world. |

The steel frame of the Francis Scott Key Bridge sits on top of a container ship after the bridge collapsed, Baltimore, Md., on March 26, 2024. (Jim Watson/AFP via Getty Images) The steel frame of the Francis Scott Key Bridge sits on top of a container ship after the bridge collapsed, Baltimore, Md., on March 26, 2024. (Jim Watson/AFP via Getty Images) |

| The story is this: Just 16 companies—eight shippers, three factory groups, and five container lessors—control 81 percent of the world’s commercial ocean transport, container production, and box-leasing capacity. |

| The eight global corporations—none based in the U.S.—that dominate international maritime commercial shipping are aligned in three self-serving “cartels” that have divided sea lanes and “cargo slots” among themselves with little concern for interests beyond their bottom lines. |

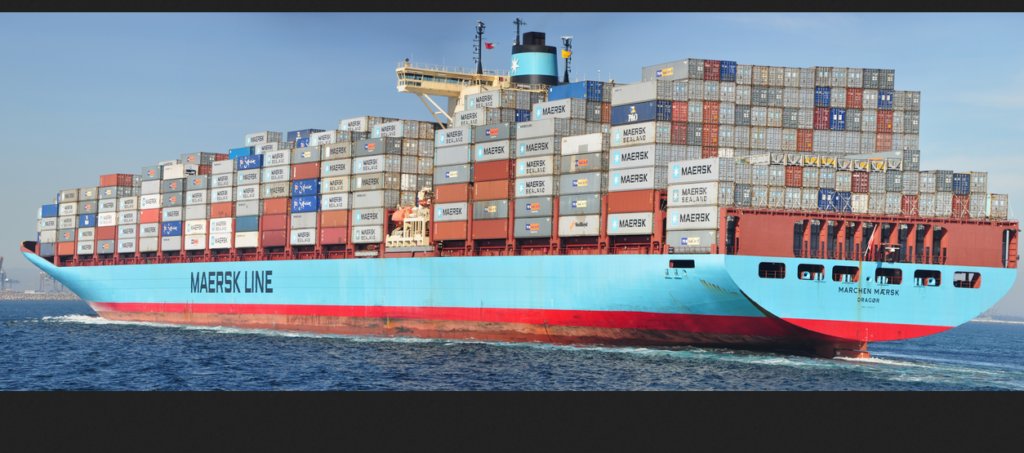

| And, so, they are building bigger and bigger ships. The bigger the ship, the more cargo it can carry. For international shipping firms, that offers an economy of scale in saving fuel and lowering the cost of transportation per container. It works for consumers with lower-cost goods. Usually. |

| Container ships have been steadily increasing in size since they were created in 1956. But it wasn’t until the early 2000s that the “Big Boat Era” truly began.

|

| Of more than 50,000 merchant ships now plying the world’s maritime trade routes, at least 5,500 are regarded as mega-ships. There are seven major types: |

|

| But they pose risks, such as cargo concentration, like what happened in Long Beach, California, in late 2021—that can degrade supply chain resilience because only a relatively few ports can accommodate them. And when one is disabled in a sea lane, such as now in Baltimore Harbor or in March 2021, when the Ever Given grounded in the Suez Canal, it can bottleneck maritime trade for weeks and cause worldwide inflation. |

| In the big ship era, one ship’s problem becomes the world’s problem. |

| The big ships pose hazards in confined waterways and the “cartel” is forcing ports— where possible—to retrofit infrastructure to accommodate them at great expense. |

| “If you build it, they will come,” Salvatore Mercogliano, a professor who analyzes maritime commerce at Campbell University in Buies Creek, North Carolina, told The Epoch Times. |

| If not, your port, your town, your industries become backwaters—or maybe your bridge gets knocked down. Baltimore’s Key Bridge joins the Lixinsha Bridge in southern China’s Guangzhou province and the Zárate-Brazo Largo Bridge on the Prana River in Argentina as 2024 victims of mega-ship allisions—a new word to learn when a massive ship runs over a stationary victim—in confined waters. And it’s still March. |

| This puts American ports in an ever-narrowing crosshair. Without a cohesive national ports and commercial maritime policy—remember when the United States had a robust merchant marine fleet?—the “shipping cartel,” as labeled by the Biden administration, will rule the waves. |

| “The way we do things in the U.S. is very unique; ports are run locally by municipal governments or states and then the waters are run by the federal government, so it creates a big problem,” Mercogliano said. “And so, you get this competition and then you have the ocean carriers” dictating winners and losers. |

| No American port can handle the newest ultra-large container vessels. It cost taxpayers $1.7 billion to raise the Bayonne Bridge so New Panamax-sized carriers could enter the Port of New York/New Jersey. It cost taxpayers nearly $1 billion to improve the Port of Savannah, but less than two years later, another study is warranted because the mega-ships can’t get up the lower Savannah River and under the Eugene Talmadge Bridge. |

| “Mega container ships are changing our ports,” acknowledges xChange Solutions, a global container-leasing company based in Hamburg, Germany, in an April 2022 analysis. While providing “benefits like high freight volume and low fuel costs” the also impose “massive port infrastructure demands” on port operators. |

| Ports around the world are struggling to cope, writes Evangelos Boulougouris a professor of naval architecture, ocean and marine engineering at the University of Strathclyde for the Maritime Safety Research Centre. “The cost of such projects is immense: the expansion of the Panama Canal in 2016 to accommodate bigger ships ended up costing over $5 billion.” |

| “Ocean carriers and the financial institutions that bankroll them aren’t paying for updated ports, increased dredging, new warehouses, highways and so on to accommodate these ships. That cost is getting off-loaded to the public,” American Economic Liberties Project Director Matt Stoller told FreightWaves in May 2022. |

| “We have a lot of ports in this country but we don’t have enough ocean carrier firms,” Stoller said. “The ocean carrier firms’ boats are too big for most ports.” |

| Many ports will soon be backwaters, the 54-member nation International Transport Forum’s 2015 “Impact of Mega-Ships” report predicted, noting the ever-growing big ships were generating cost savings for carriers and decreasing maritime transport costs for shippers, but reducing the number of ports that can accommodate them. |

| Which brings us back to Baltimore Harbor. |

| “A long-term fear of Baltimore’s is they may lose business permanently because of [the Dali crash] and that’s because they’re saying in New York/New Jersey, ‘You can just shift your cargo here,’” Mercogliano said. “ |

| I hate to say it—you know, no one will say it— but you there are four port directors up and down the East Coast are going. ‘Thank God that’s not my port … but, how can I use this to get some business my way? You know, how can I grow Philadelphia? How can I grow Savannah? Because that’s what they do. They have to compete against each other. There’s a finite amount of cargo out there.” |

Welcome to Sterling Cooper, Inc.

- CALL US: +1-866-285-6572

- CALL US: +1-866-285-6572