Wind Waste Plagues Countries That Shelled Out for “Green Energy”

Wind Waste Plagues Countries That Shelled Out for “Green Energy”

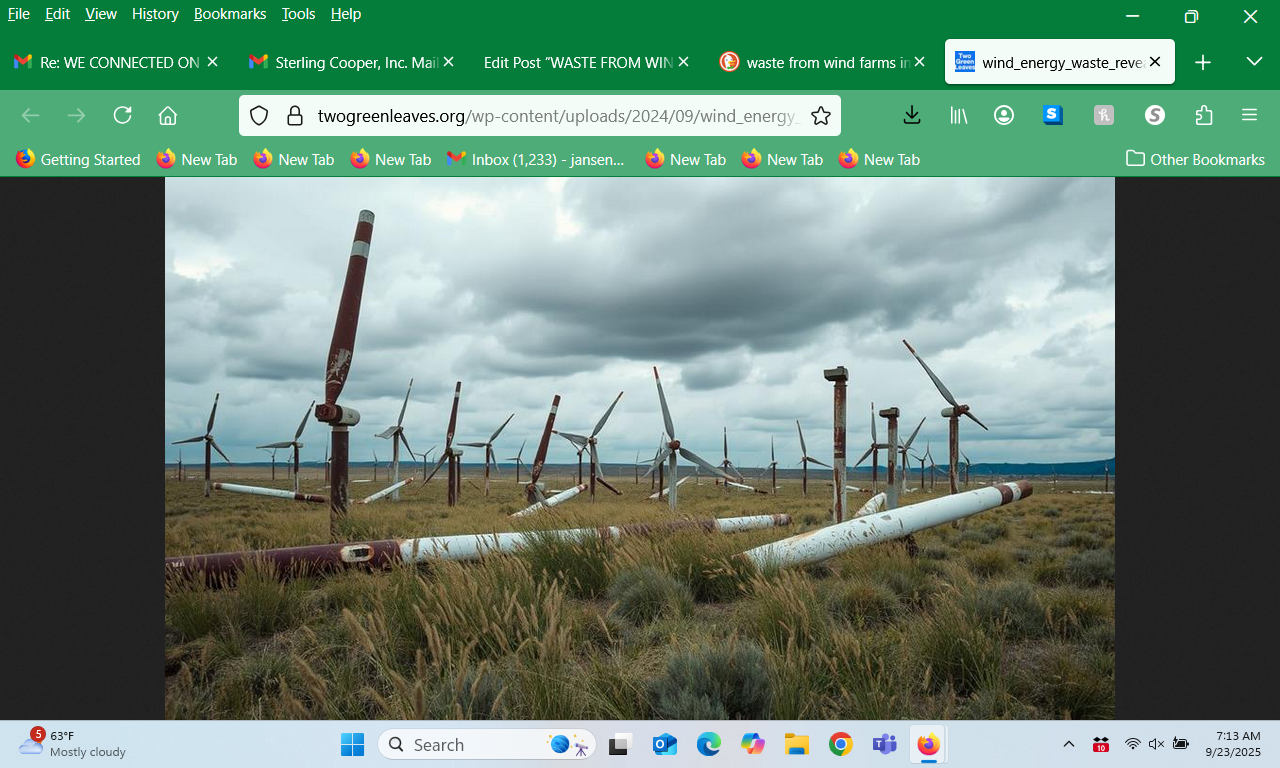

—Across Europe, countries that once went all in on wind power are now grappling with impending piles of discarded turbine parts and scrambling to find ways to recycle them, The Guardian reports.

One Scottish town is already struggling under the weight of wind turbine waste as other countries like Germany, Spain and Italy are investing in recycling efforts after pledging major investments in wind power, The Guardian reported. Europe has 14,000 wind turbines to dismantle by 2030, which will leave them with 44,000 to 66,000 tons of unrecyclable blade waste, according to WindEurope.

“Wind energy not only has a reliability problem; it has a recycling problem. … Proponents in Scotland and here in the U.S. say these structures have a 20-year lifespan. But many stop working within five to 10 years,” Director of Independent Women’s Center for Energy and Conservation Gabriella Hoffman told the Daily Caller News Foundation.

“The wind industry has a massive problem on their hands with turbine parts piling up in landfills. Trust in the industry is waning, since it’s a part-time energy source that produces expensive energy while utilizing large swaths of land. Wind energy is weather-dependent and can’t replace natural gas, nuclear, or coal to meet rising electricity demand. The U.K. must quit its addiction to net-zero and adopt an energy abundance posture.”

Several European countries, including Scotland, Germany, Spain, and Italy, have pledged to reach net-zero emissions by 2050 and are working to meet specific targets for wind-generated energy on their grids. Several companies across the industry are working with some government bodies to develop a new generation of wind turbine blades that are easier to recycle, according to The Guardian.

America may also face mass amounts of blade waste by 2050, according to a 2020 Electric Power Research Institute projection.

While the Biden administration pushed for both wind and solar power, the Trump administration has recently taken a tougher stance on wind, with the Department of the Interior (DOI) announcing that it will no longer grant the industry the “preferential treatment” that former President Joe Biden supported.

Notably, wind turbine waste has also been scattered across Texas, with some residents voicing concerns to a local outlet in 2023 over the potential hazards and rattlesnake infestations.

It Still Doesn’t Matter: Now the Entire British Establishment Is against the British People, Things Will Only Get Worse

It Still Doesn’t Matter: Now the Entire British Establishment Is against the British People, Things Will Only Get Worse

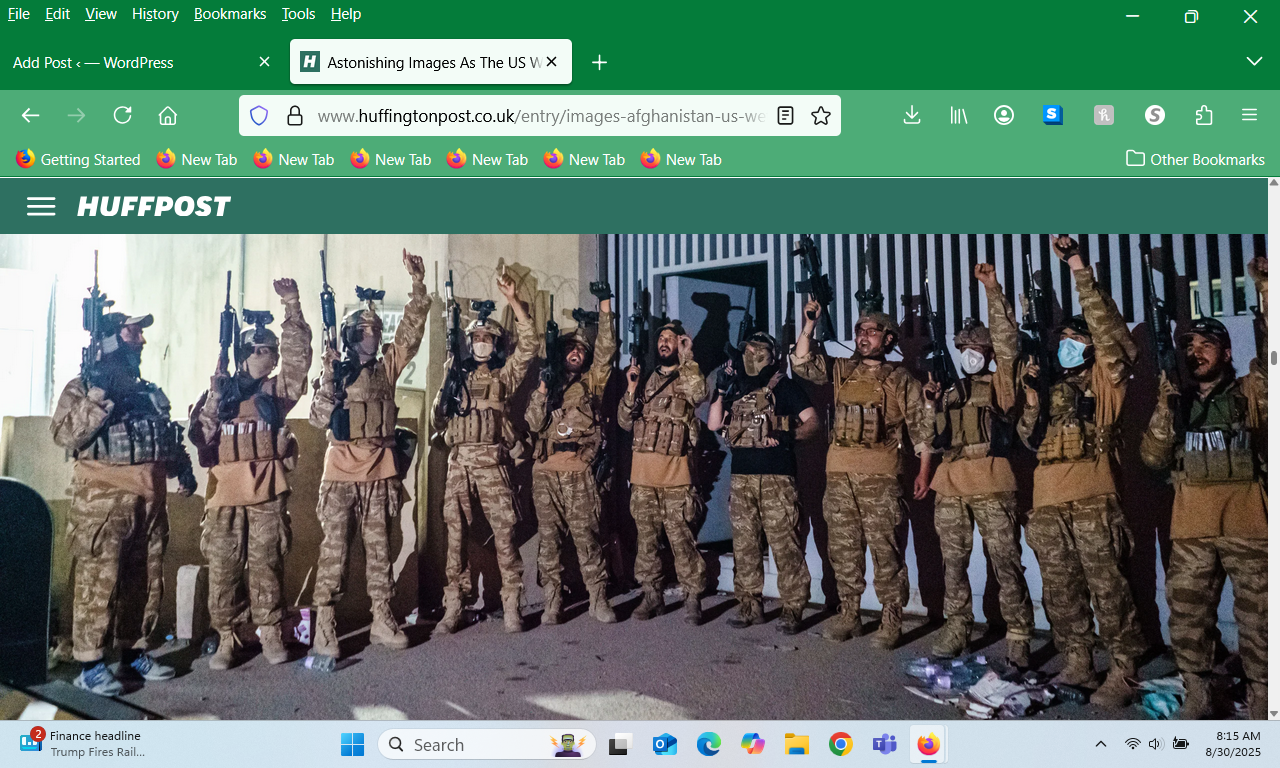

Chairman of the Joint Chiefs of Staff Mark Milley and CENTCOM Commander Frank McKenzie repeatedly ran cover for the Taliban’s behavior in 2021, denying that the Taliban had carried out attacks against U.S. and NATO bases during the withdrawal and defending the Taliban’s behavior during the evacuation.

Chairman of the Joint Chiefs of Staff Mark Milley and CENTCOM Commander Frank McKenzie repeatedly ran cover for the Taliban’s behavior in 2021, denying that the Taliban had carried out attacks against U.S. and NATO bases during the withdrawal and defending the Taliban’s behavior during the evacuation.