China would defeat the US military in a war over Taiwan, according to a top-secret US government assessment.

US reliance on costly, sophisticated weapons leaves it exposed to China’s ability to mass-produce cheaper systems in overwhelming numbers, the highly classified “Overmatch Brief” warns.

A national security official under Joe Biden who reviewed the document is said to have turned pale on realising Beijing had “redundancy after redundancy” for “every trick we had up our sleeve”, The New York Times reported.

Losing Taiwan, the US’s key bulwark against Chinese power in the western Pacific, would deliver a severe strategic and symbolic blow to Washington.

The country’s most advanced aircraft carrier, the USS Gerald R Ford – recently sent to the Caribbean for Donald Trump’s crackdown on drug traffickers – is often destroyed in the wargames outlined in the brief.

The $13bn (£9.75bn) vessel, which entered service in 2022 after years of delays, is vulnerable to attacks from diesel-electric submarines and China’s arsenal of some 600 hypersonic missiles, capable of travelling at five times the speed of sound.

Beijing displayed its ship-destroying YJ-17 missiles, estimated to travel at eight times the speed of sound, at a military parade in September.

Nevertheless, the Pentagon is planning to build nine additional Ford-class aircraft carriers, while it has yet to deploy a single hypersonic missile.

Eric Gomez, a research fellow at the Taiwan Security Monitor, said the end result was unclear when he participated in a wargame for a Taiwan conflict, but noted the US suffered heavy losses.

“The US loses a lot of ships in the process. A lot of F-35s and other tactical aircraft in the theatre are degraded pretty rapidly too,” he told The Telegraph.

“I think the high cost of it was really sobering when we did the after-action summaries, and we’re like, ‘Okay, like, you guys lost 100-plus fifth-generation aircraft, multiple destroyers, a couple of submarines, a couple of carriers’.

“It’s like, ‘oh gosh, man, that was a heavy toll’.”

Hegseth: China could destroy US carriers in minutes

Last year, Pete Hegseth, the defence secretary, said that “we lose every time” in the Pentagon’s war games against China, and predicted the Asian country’s hypersonic missiles could destroy aircraft carriers within minutes.

China has significantly expanded its arsenal of short, medium, and intermediate-range missiles, which means it could destroy many of the US’s advanced weapons well before they could reach Taiwan.

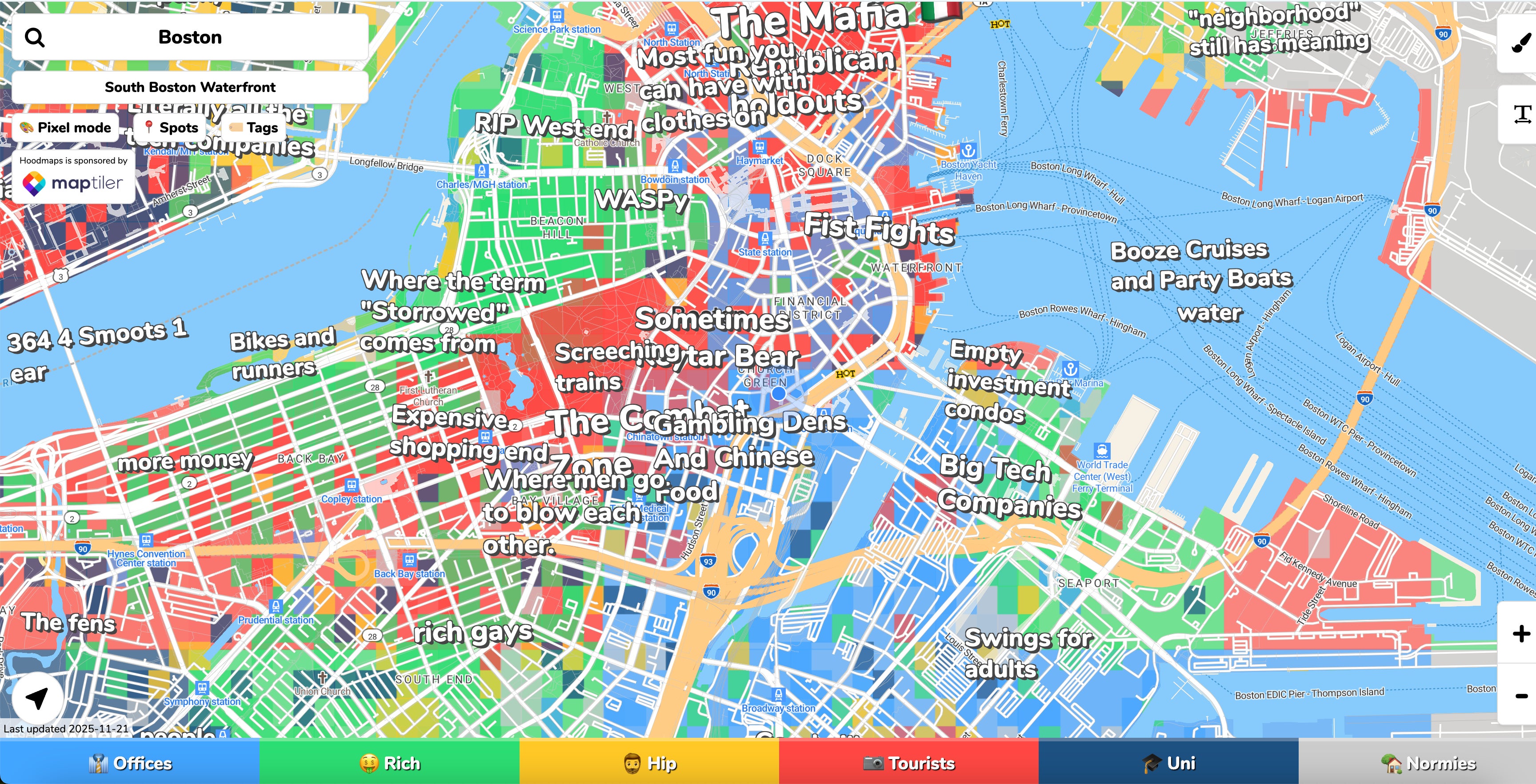

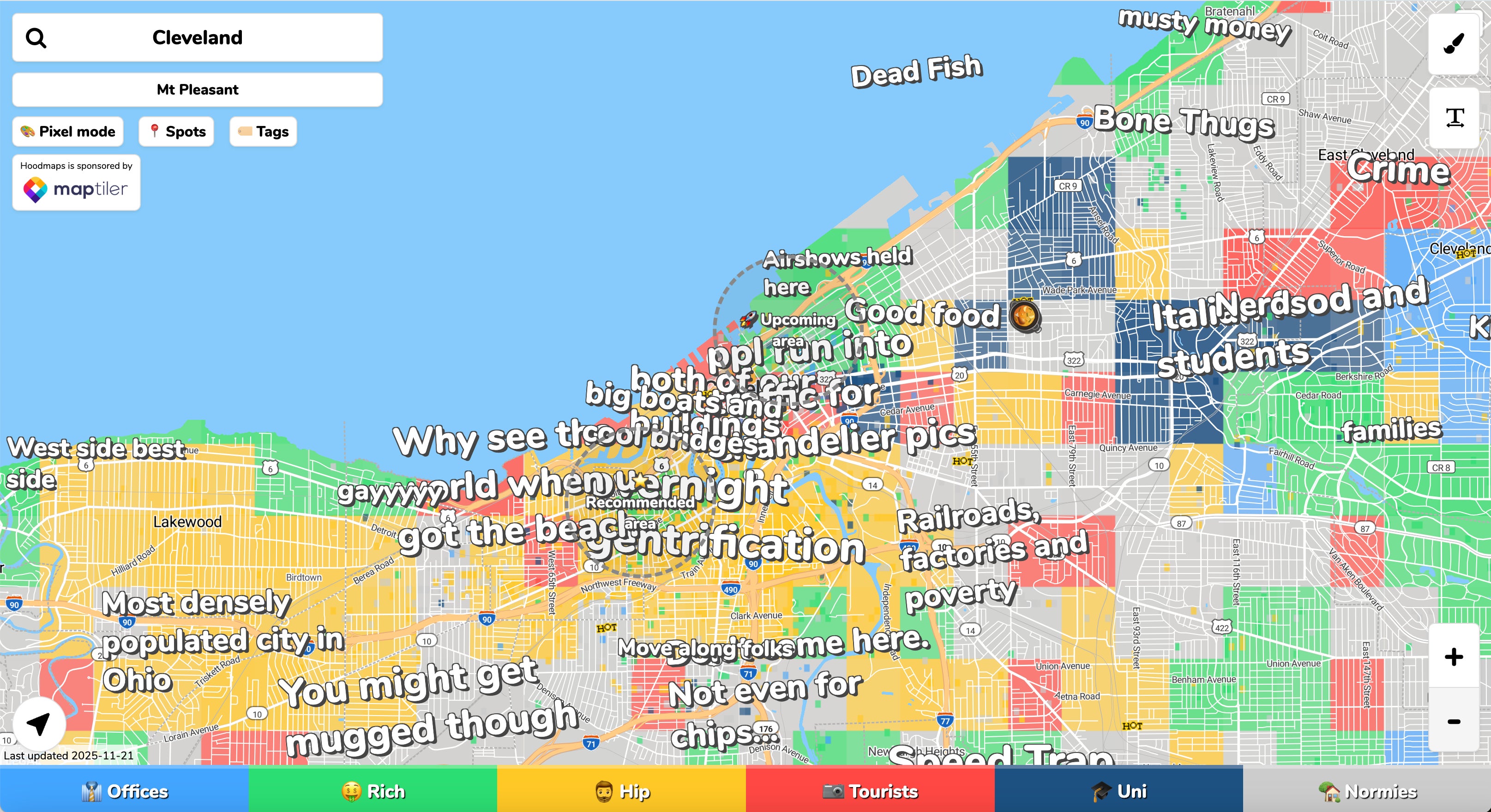

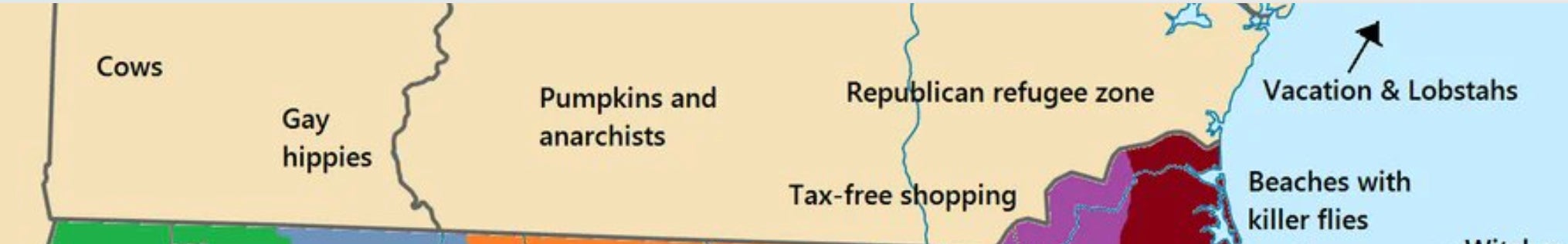

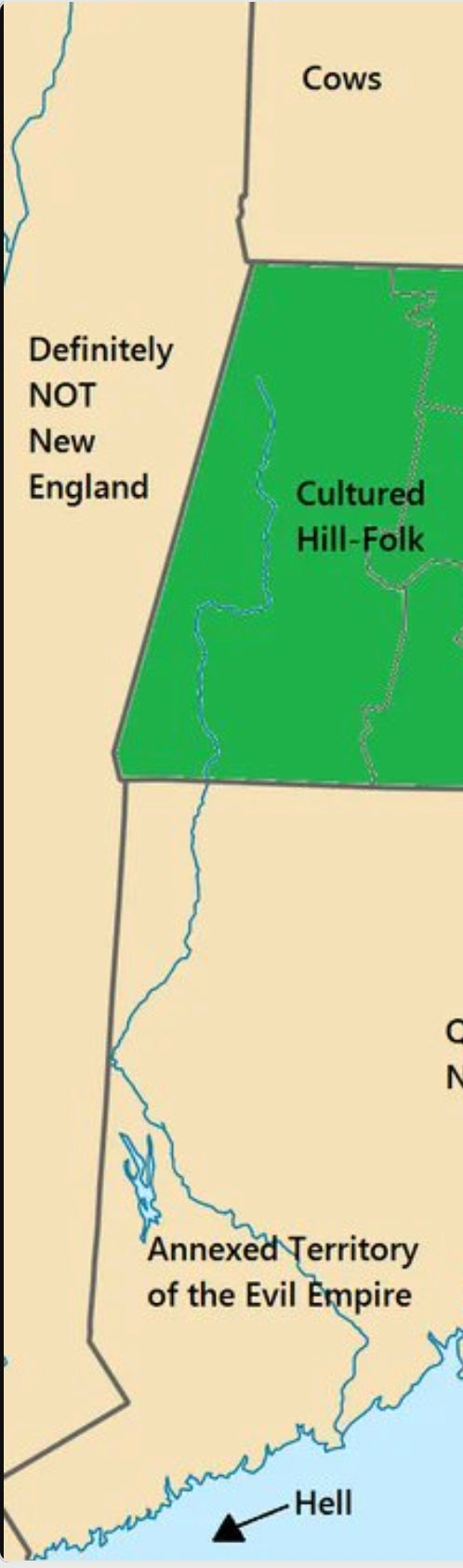

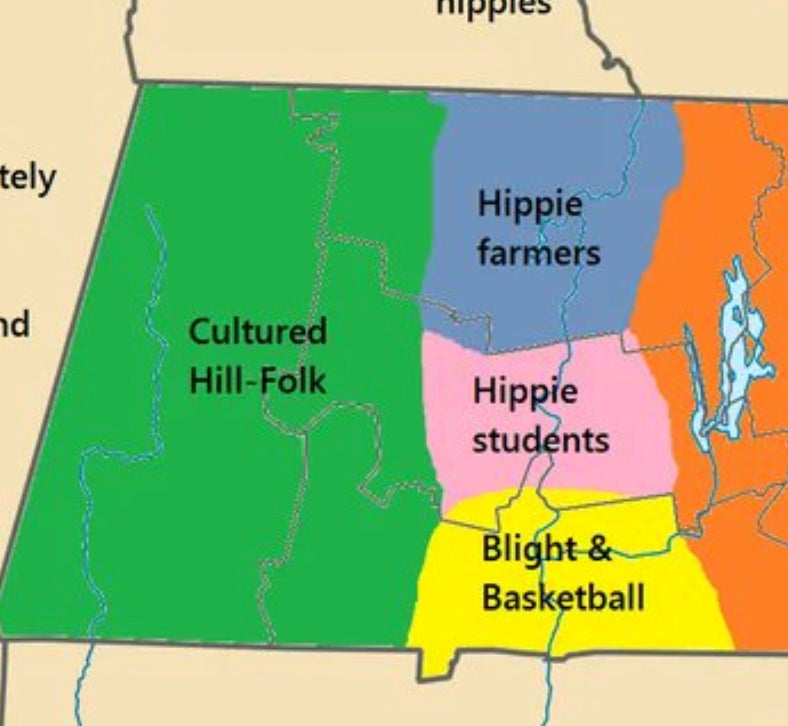

Definitely NOT New England

Definitely NOT New England Hippie farmers

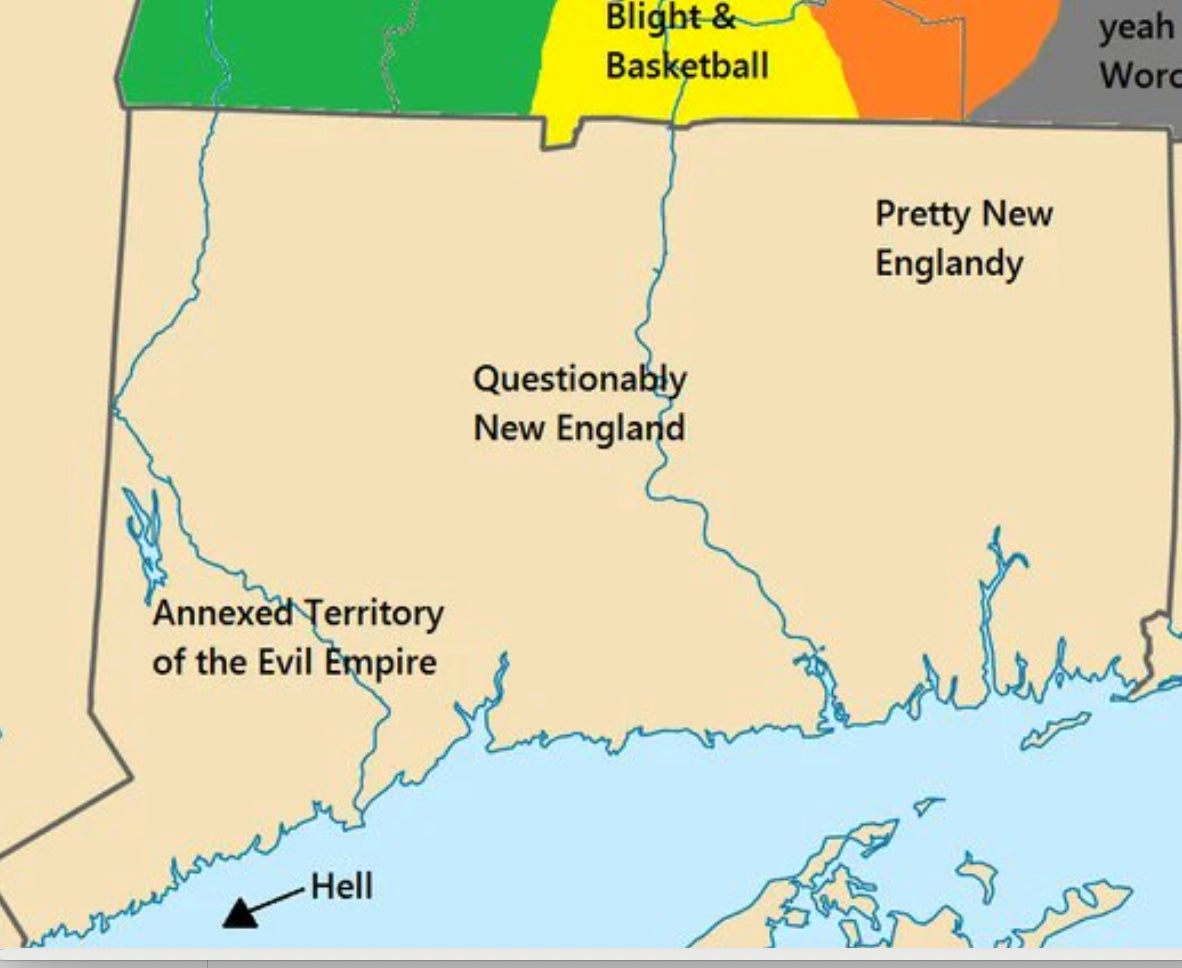

Hippie farmers Annexed Territory of the Evil Empire

Annexed Territory of the Evil Empire THERE BE DRAGONS HERE

THERE BE DRAGONS HERE

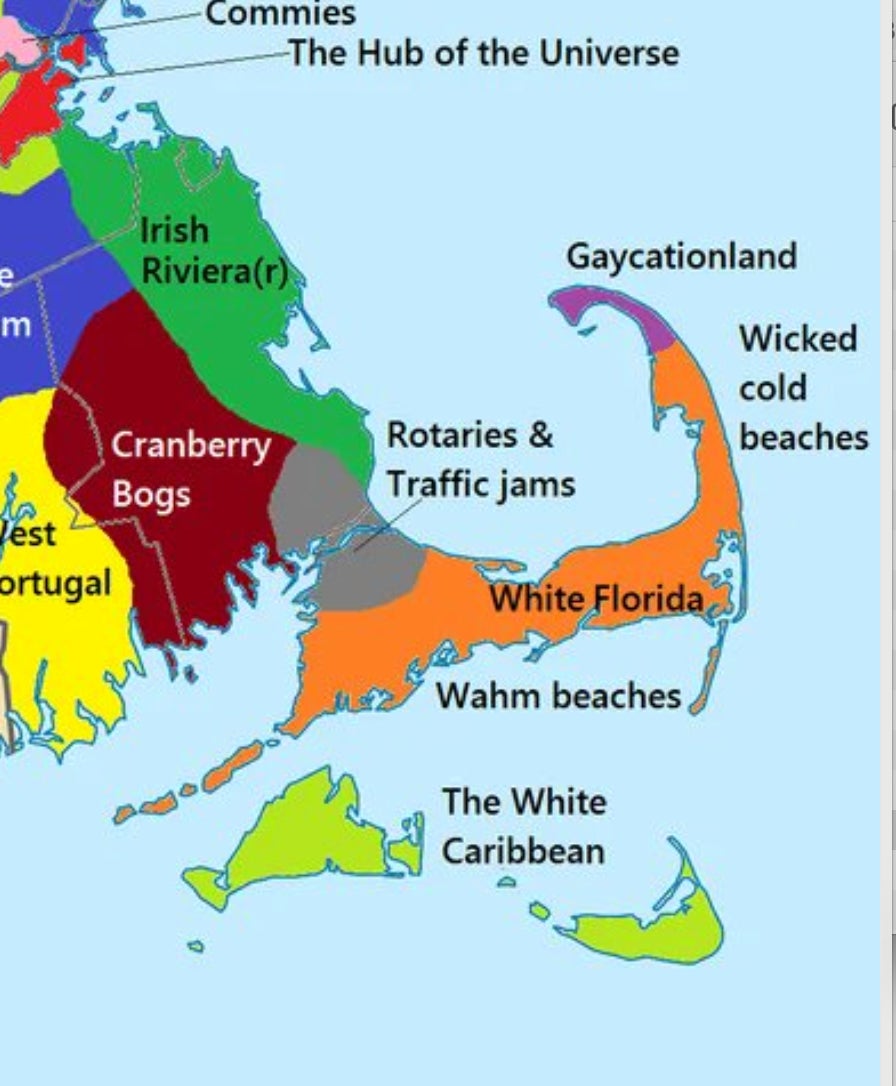

Boston And Friends

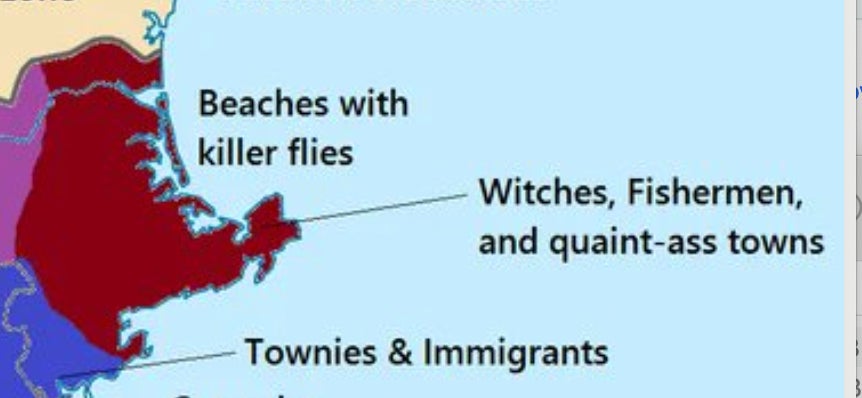

Boston And Friends Townies & Immigrants

Townies & Immigrants Witches, fishermen, and quaint-ass towns

Witches, fishermen, and quaint-ass towns Gillette Stadium

Gillette Stadium Questionably New England

Questionably New England White Florida

White Florida