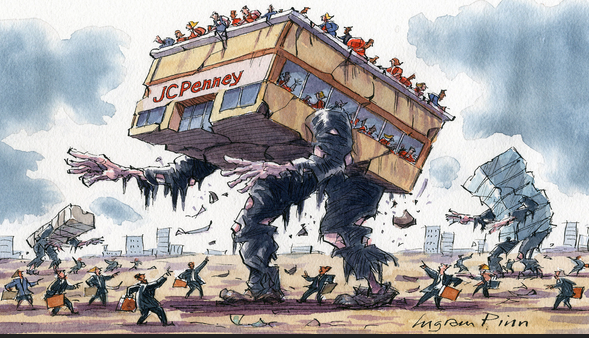

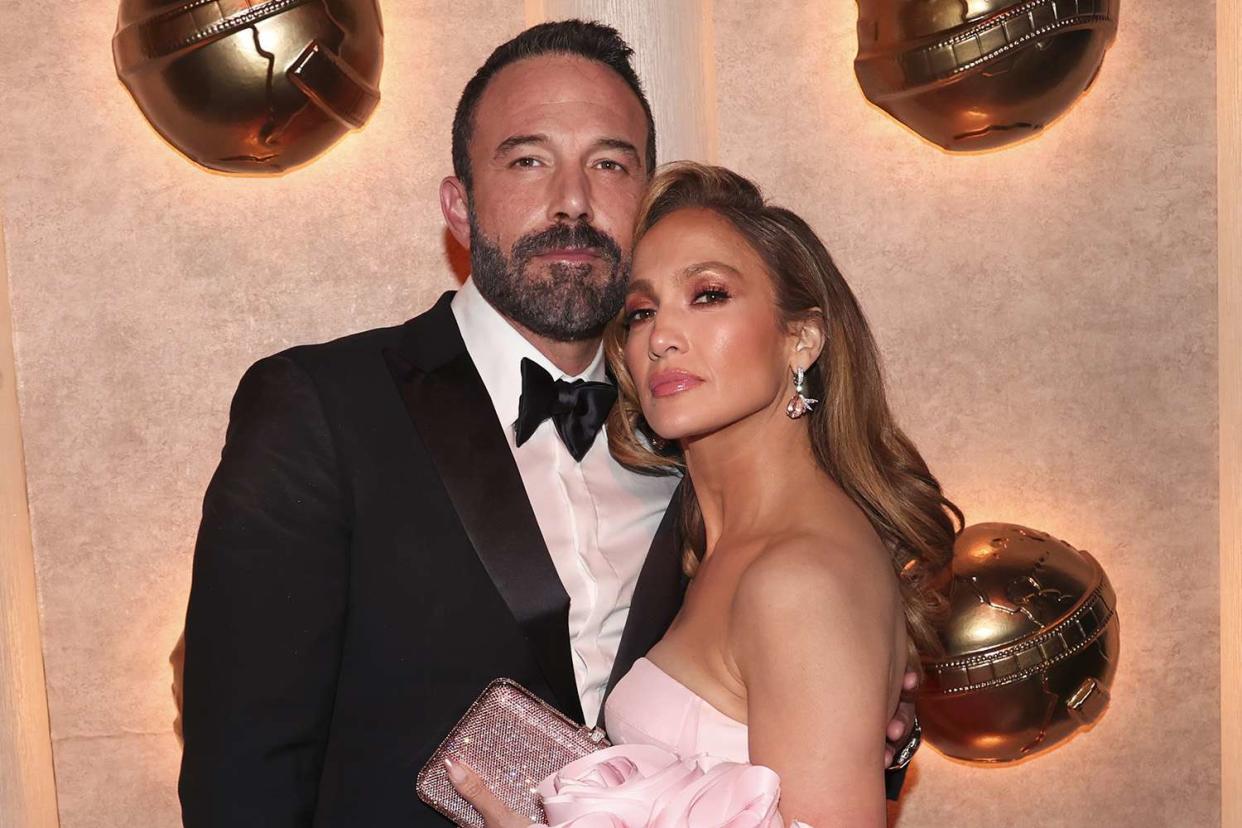

Inside Jennifer Lopez and Ben Affleck’s Multimillion-Dollar Real Estate Empire

A source told PEOPLE the couple are selling the Beverly Hills home they’ve shared since 2023

Jennifer Lopez and Ben Affleck are quietly trying to sell the $61 million Beverly Hills mansion they’ve shared since June 2023, an insider told PEOPLE. But the impressive spread is far from their only major chunk of real estate.

Amid reports of a strain in their marriage, a source close to Lopez said that neither of the two stars has been happy with the home, which they purchased after a long house hunt in June of last year.

“Ben never liked the house. It’s too far away from his kids,” said the source, adding that the house is “way too big” for the singer. The massive property features 12 bedrooms and 24 bathrooms.

Of course, both Lopez, 54, and Affleck, 51, have owned plenty of other high-profile properties. Here’s everything to know about all the places they’ve lived throughout the years.

Beverly Hills

The couple bought the 38,000 square-foot home they’re currently trying to sell in the spring of 2023, per the TheWall Street Journal, after tying the knot the previous year.

Located on five acres of land, the house has “12 bedrooms, 24 bathrooms, a 12-car garage and a pool, plus a sports complex with basketball and pickleball facilities, a gym and a boxing ring,” according to the newspaper.

Bel Air

Lopez found a buyer for her previous Bel Air mansion in October 2023, according to a report from the Journal. First listed for $42.5 million in February of that year, the eight-acre estate eventually sold for just under $34 million.

At more than 12,000 square feet, the sprawling property features nine beds and 12 and a half baths. Originally designed by architect Samuel Marx, it was later reworked into a French country-inspired retreat, according to the listing.

Fittingly, at the time of the listing, a private screening room on the lower lounge level featured posters for Lopez and Affleck’s movies.

The Maid in Manhattan star unloaded her $25 million New York City penthouse in April 2024, after seven years on and off the market.

The asking price for the four-bedroom, seven-and-a-half bathroom property, located near Manhattan’s Madison Square Park, was most recently $24,990,000, though its listing agents didn’t confirm the final sale price.

The 9,500-square-foot space is in a historic 1924 mansion conversion and features an indoor/outdoor design with four private terraces that offer views of the New York City skyline.

Amenities include a full-time doorman, top-of-the-line kitchen with a large island, a stainless-steel wine fridge, breakfast bar and a private guest wing with three bedrooms, staff quarters and a laundry room.

Pacific Palisades

Affleck listed his Pacific Palisades home in August 2022 for $30 million, following his marriage to Lopez. The 13,500-square-foot property, featuring seven bedrooms and nine bathrooms, is located near the swanky Riviera Country Club, with mountain views.

Per the Los Angeles Times, he sold it for $28.5 million in October 2022.

The Argo director purchased the then-newly-built gated property in 2018 for $19 million after his divorce from ex-wife Jennifer Garner, according to the Journal.

Miami’s Star Island

Lopez and former fiancé Alex Rodriguez, purchased a 10-bedroom mansion on Miami’s Star Island for $32.5 million in 2020, according to WSJ

The exclusive island, which is located in Biscayne Bay, is known to attract A-list residents.

Malibu

Lopez and Rodriguez, who ended their engagement the following April, put their Malibu fixer-upper on the market in July 2020.

They listed the five-bedroom, four-and-a-half bathroom oceanfront home for $7.99 million, after having purchased it from Entourage actor Jeremy Piven for $6.6 million in February 2019, according to the L.A.Times.

The home, spanning more than 4,400 square feet of living space over three levels, is in the heart of Malibu, with over 50 feet of private beachfront. It features walls of glass and expansive terraces on each level overlooking the Pacific Ocean.

In March 2019, shortly after the couple bought the property, home renovation star Joanna Gaines visited the couple there and was photographed with a film crew on the beach outside. A source told PEOPLE at the time that Gaines was considering helping Lopez and Rodriguez remodel the home.

It sold for $6.775 million, less than two months later, according to the Journal.

Hamptons

In 2013, Lopez dropped $10 million on a three-acre Hamptons property on New York’s Long Island, according to Forbes. The 8-bedroom, 7.5 bathroom home includes a pool, pool house, theater, sauna, steam room and covered porches.

Hidden Hills

Lopez bought this sprawling California estate in 2010 for $8.2 million, and completely renovated it during her time there, according to the Los Angeles Times. She sold it for $10 million in 2017.

Some of its highlights included formal and informal living rooms, a primary suite with a sitting room and a private terrace, dance and recording studios, a 20-seat theater, a game room, a speakeasy-style bar and a resort-style swimming pool.

Long Island

Lopez lived in a Brookville, Long Island, mansion when she was married to Marc Anthony, between 2004 and 2014.

“It was the place they brought their kids up,” Douglas Elliman vice chair Dottie Herman told ABC News, referring to Max and Emme, the twins Lopez and Anthony welcomed in 2008. “It’s hard to believe with J.Lo and Marc Anthony that they were regular people, but their kids and them had a normal life in a wonderful place that they felt was their home.”

The home was listed for $9 million in 2015, and according to Newsday, sold for $4.5 million in 2017.

Georgia

Affleck purchased an 87-acre property on Hampton Island Preserve outside Savannah, Georgia, as a getaway in 2003, reportedly paying $7.11 million for it, according to the Wall Street Journal.

The compound, which includes three houses, river access and a dock complex, served as the site of wedding celebrations Affleck and Lopez held with friends and family in August 2022, a month after getting married in Las Vegas.

The pair had “an extraordinary weekend of celebrations planned,” leading up to their second wedding, including “a pre-wedding party, a ceremony and … lots of fun lined up,” a source told PEOPLE at the time.

Miami

According to Forbes, Lopez owned a 1929 waterfront property on Biscayne Bay until selling it in 2005 to businessman Mark Gainor, who renovated the home. The 1.2-acre property included seven bedrooms, nine and a half baths and Miami skyline views.

In 2015, Phil Collins paid $33 million for the property.

The Summit

According to Trulia, Lopez owned a Los Angeles mansion called The Summit from 2000 to 2004. Gwen Stefani purchased the seven-bedroom, seven-and-a-half-bath residence with Gavin Rossdale in 2006 and sold it for $21,650,000 in 2019.

Features touted in the listing included an infinity pool, playground, chicken coop, lighted tennis court and expansive outdoor living spaces.

Is love just great the third, fourth and fifth time around???